About Us

Who We are?

Finway FSC is a digital lending marketplace which offers financial services to retail, high-net-worth individuals, institutions, and corporations. It deals in both Secured and Unsecured loans which are strategically tailored as per the needs of market and customers.

Finway FSC is an organization that motivates people to fulfill their dreams that would be difficult to achieve earlier due to the inaccessibility to right financial consulting and solutions. Finway FSC is expanding its boundaries from Delhi/NCR to top ten cities of the countries, including the four metros and this expansion is due within 2 years. Also, Finway FSC is planning to launch the concept of Offiine Loan Shops in major locations for people.

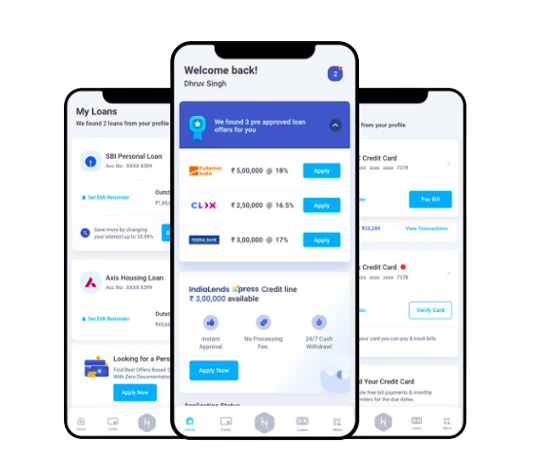

Finway FSC has its active Agent App called "FLAP", an acronym for Finway Loan Assist for Partners on iOS and Android platforms. The aim behind launching this app is to consolidate the market, encourage common man to be an entrepreneur and to give loan seekers the best solutions in real time in a transparent manner. Using this app, the Finway agents can virtually process business loans, personal loans, education loans, home loans and loan against property and even track their earnings in real time. All in all, FLAP's commission structure is totally a win-win strategy for customers, agents, and for financial institutions.

What We Do

Finway is on a mission "To empower Indians by way of digitalizing entire lending process for Personal, Business and Education Loans"

Finway FSC is your one-stop destination for all types of loans in India. We help you compare and choose from various financial products across categories such as personal loans, home loans, Business Loans and Loan Against Property. We work with over 50 partners that include India`s leading banks, FSC.

Our intuitive platform compares product offerings on the basis of key criteria such as processing fees, interest rates, tenure and other features that matter the most to you. Apart from providing unbiased comparison insights, we also provide you with best-in-class assistance so that you get the best possible deal with minimum hassles.

In a nutshell, Finway FSC ensures you are provided with the best product through the most convenient and hassle-free processes.

Why choose us?

Finway FSC is the only online financial marketplace in India that offers a complete spectrum of financial products, ranging from retail lending products, personal loans, home loans, loans against property and many more.

We also have an exclusive FINWAY LOAN ASSIST FOR PARTNERS to help you become your own boss.

So, rather than basing your decisions on advertising campaigns and the sweet writing on brochures, connect with us to help you take your financial decisions right and smart

Finway FSC is the only financial entity in India that offers a credit report with monthly updates to its users. Absolutely Free. Finway FSC has integrated the free credit check in the product journey, helping customers see all lending products that he is eligible for and his chance of approval against each. This helps customer choose the right product, basis his profile and credit score.

Finway FSC offers customized solutions to all lending and investment needs of a customer. Our comparison engine is an intuitive platform that provides unbiased choices to our customers, based on his profile and needs. After processing the latest financial numbers from virtually all banks and fiscal organizations, this engine helps users arrive at a smarter decision instantly.

Finway FSC also helps customers make the right choice and assists them throughout the transaction process with the bank. A seamless product journey and assistance over the phone from our sales force, makes the entire buying process at Finway FSC simple and speedy.

Finway FSC is focused on using technology to build presence-less and paperless solutions in the financial services aggregation space. Riding on the Indian Government?s ?India Stack? initiative that aims to digitize customer identification and verification, Finway FSC is developing solutions where processes are completed on its platform without the need for customers to either visit banks or do multiple sheets of paperwork.

At Finway FSC, we help you not just in securing a loan but also in making an informed decision through our Tools and Learn sections. We have a plethora of online tools and calculators that help you in identifying your loan eligibility, EMI amount and even savings possible when transferring a loan. Our online tools and calculators allow you to perform a thorough comparison pertaining to your specific requirements and chosen product.

Awards and Achievements

- Finway Financial Services Company has won ET BFSI Award 2020 for the "Most Admired Service Provider in financial sector"

- Finway Financial Services Company has won excellence in financial products, Branding award by indian brand convention and bam Awards 2019.

- Finway Financial Services Company has also won the excellence in artificial intelligence and finance award by indian startup convection and startup excellence award 2018.

- Finway has been honoured with the title of tech company to watch out for business world disrupt techtors.

VISION

To be the simplest transparent and quickest digital lending platform of India "

The 4 pillars of our vision that will help us achieve it are:

To be a leader

We are committed to being a leader in all facets of our businesses, rather than being just another participant in this race.

To be a role model

We will not become leaders by cutting corners or making compromises. Whatever we do, we will strive to be the best in class. And if we are the best, then our customer will have no reason to go elsewhere - therefore our leadership is assured, on pure merit.

To be a broad-based player

We are committed to meeting all the felt and unfelt needs of our target customer. And thereby, we can retain him or her across their needs and lifestages

We aim to be an integrated player

We believe that this approach gives us a competitive edge with regards to all our key stakeholders.

MISSION

To empower Indians by way of digitalizing entire lending process for Personal, Business and Education Loans"

Our goal is to unite people and entrepreneurial ideas to create opportunities for a better world. There are so many challenges facing the world today, but we believe that by bringing the right people together and taking an entrepreneurial approach, we can create positive change.

Our work is divided into four areas:

Changing business for good

We believe business can be a driving force for social, environmental and economic benefit.

Market solutions to address climate change and conserve our natural resources

We believe businesses have a big part to play in creating opportunities from the challenges we face.

The power of entrepreneurs

We help early stage entrepreneurs build credible business plans for growth that have a positive impact in the world.

Human dignity

We work to protect every human's basic rights and freedoms through shining a spotlight on issues that we feel are unacceptable.

We know we can't change the world on our own, so we bring together entrepreneurs, philanthropists and inspirational leaders - then we collaborate for good. We want to form a powerful global community that are able to drive change.

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a personal loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!

Featured In

FAQs

What kindly security accepts by the banks while applying for a business loan?

Currently, to avail business loan banks we do not ask for any security. The business loans are offered based on the evaluations of the submitted documents along with the duly filled application.

I am event manager and have been working in the industry for almost 9 years. Am I eligible for a business loan to set up my event management company?

Yes, you will be eligible for availing a business loan based on the evaluation of the submitted document along with your business plan.

Do banks ask for personal details to use an EMI calculator of a business loan?

No, it is not mandatory to provide personal details to use an online EMI calculator

Where I can use the amount received via business loan?

You can apply for a business loan to fulfill the below requirements-

- Fund your new or existing business

- Make additional capital available for your business

- Renovation of home

- Expansion of business

- Expenses for your child's education

How long it takes to know the eligibility of business loan?

In the advent of the Internet, today, most of the banks and lenders offer efficient online services to its customers. With the help of online banking tools, applicants can check their eligibility to avail a business in a fraction of one minute

How much is the minimum and maximum loan amount I can get?

The minimum loan amount offered is Rs. 5,000 and maximum loan amount can exceed Rs. 2 crore, depending on the requirements.

What is the maximum age of availing business loan?

The maximum age of availing a business loan is up to 65 years.

What is the interest rate offered under Business Loan?

Interest rate offered by various banks and Financial Services Companies starts from 14.99% onwards.

For how long I can repay the loan amount?

You can repay the loan amount in minimum 12 months and maximum up to 5 years, depending on the respective bank or Financial Services Company.

Do I need to submit any collateral to bank before applying for a business loan?

No, you are not required to submit any collateral to bank or Financial Services Company.

What are the foreclosure charges and processing fees of business loan?

The foreclosure charges and processing fees varies from bank to bank. Every bank and FSC has different charges, so you need to check online from their official website.